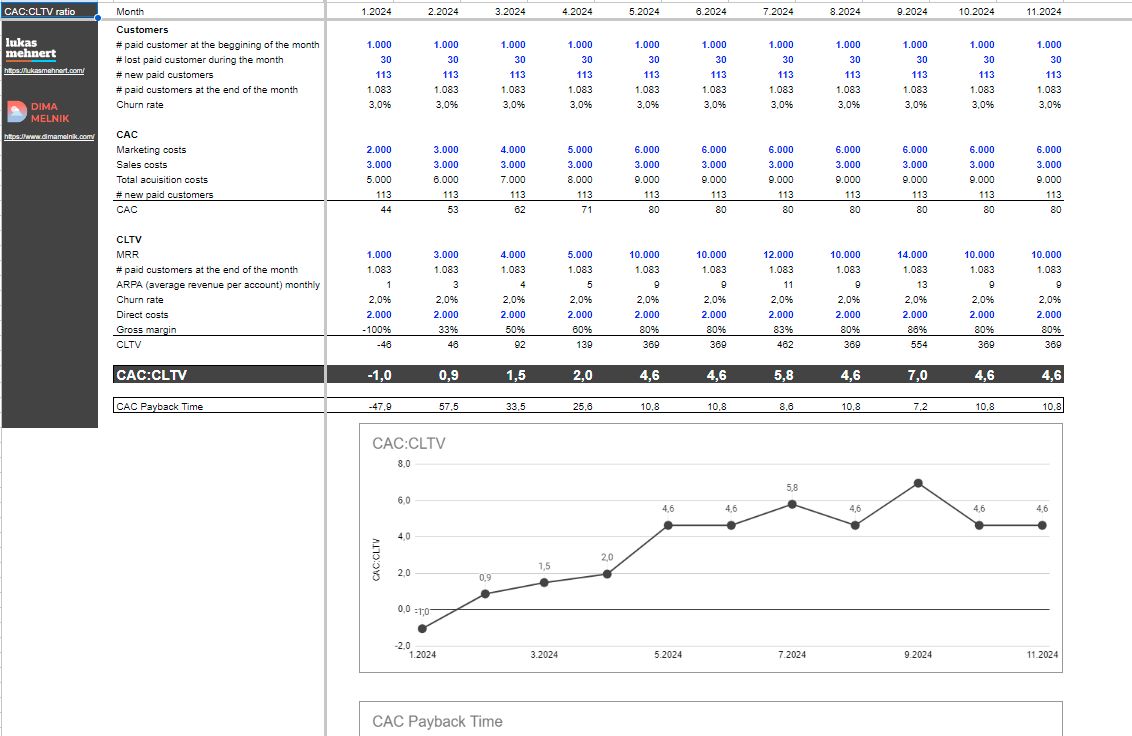

What is the ideal B2B #SaaS CAC vs CLTV? Most investors preach the gospel of 1:3, but sometimes, the ratio needs a rethink. 💸 For #bootstrapped #startups, aim higher - Dima Melnik and I are recommending 1:4-5. Why? Sustainable growth trumps rapid burn. Reinvest in building an empire, and keep your future options open. 🚀 Please take a look at future releases, product upgrades, and pricing strategies in your optimization plays. It can be wise to optimize for 1:6 in the first half, then go aggressive at 1:2 in the second with marketing splurges. 🎯 At Smartlook, we optimized to 1:5 to impress investors. This tremendously helped us get more and better offers from investors. I'll cover this in another post. 🔎 However, a low CLTV:CAC ratio isn't necessarily inefficient. The cost of your products or services, pricing, and customer lifetime are also pivotal factors. 🧐 Flipside: A ratio over 5.0 means you must be more aggressive in finding new customers. Leaving growth on the table. 😬 It's a delicate balance, this CLTV:CAC dance. The key? Deeply understanding your specific metrics and market dynamics to optimize returns. 🕺 A ratio of 3+ indicates that a business is profitable. The revenue exceeds the cost to acquire clients and serve them. Why is it important? → There is enough profit to invest in the product and marketing → You have a sustainable and long-term business model → Investors are confident in the growth potential of the company Let me know if you want a spreadsheet model that calculates it quickly. 😉

B2B SaaS CAC vs CLTV and CAC Payback Time