Cash burn benchmarks

No alternative text description for this image

- Kyle Poyar 2mo Edited Like Comment

- Calvin Arterberry 1mo Kyle Poyar 2mo Edited Like Comment

- D'Arcy Rahming Jr 1mo Kyle Poyar 2mo Edited 2 Like Comment

- Growth Unhinged 1mo Kyle Poyar 2mo Edited Like Comment

- Jai Kumar Shah 🧑🏻💻 8mo Edited 20 3 Comments Like Comment

- Josh Norris 2mo 18 4 Comments Like Comment

- Ashutosh Prasad 2mo Edited Like Comment

- Sarvesh Agarwal 8mo 17 6 Comments Like Comment

- Rishab Kumar Ojha 11mo 5 Like Comment

- Rishav Agarwal 8mo 313 55 Comments Like Comment

Cash Burn is spending, expanses. In the early stage, founders have to keep it under control. #SAAS startups become profitable faster if cash burn has to be managed. Below is a study from 700+ SAAS companies and study - Normal Monthly Cash Burn

Operating Partner @ OpenView | Growth Unhinged 🚀

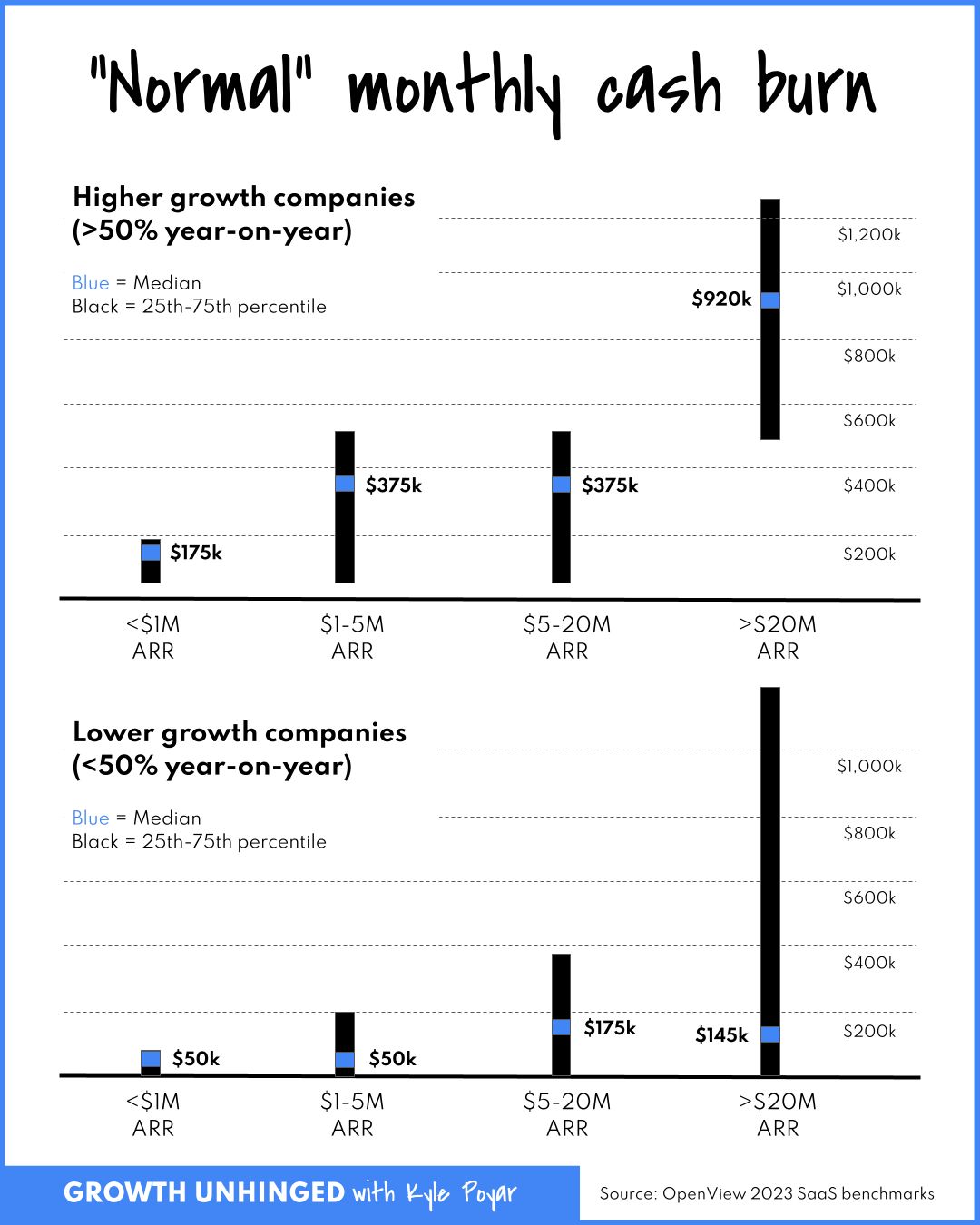

What's a "normal" burn rate for a startup? ⤵ Here are benchmarks from 700+ SaaS companies. A few observations: 1. There is no optimal burn rate. - What's healthy for one business might lead another startup to run out of cash. - Consider the level of cash on hand & confidence that any investments will leave the business better off. 2. What's "normal" today looks wildly different from 2021/2022. - Median burn rates are down materially year-over-year. - The biggest decreases are among SaaS companies with $5M+ ARR & especially those with $20M+ ARR. - The median monthly burn rate for a $20-$50M ARR biz fell from $1.5M (2022) to only ~$100-150k (2023). 3. "Normal" depends on your size and growth rate. - Higher growth SaaS companies with $20M+ ARR are still burning an average of ~$1M per month. Only ~5% of these companies are breakeven or profitable. - On the flip side, a lower growth SaaS company with $1-5M ARR is now only burning ~$50k per month. About ~25% of these companies are breakeven or profitable. 4. Be prepared for potential layoffs if burn starts to diverge from growth. According to layoffs.fyi, tech layoffs increased again in January to ~31,000 people. The silver lining is that this is down by almost 70% from the peak in January 2023 (~90,000 people). Let me know what you think: is this level of burn "healthy" or are we going to see even more cuts in 2024? -- 🎁 PS - Tap "view my blog" below my name for more data & stories about growing a SaaS startup. #saas #finance #startupfunding

To view or add a comment, sign in

Product Design Consultant | Talent Matchmaker | Tech Stars Anywhere 2022 Alumni 🚀 | Lifelong Entrepreneur

Great insight by @kyle poyer on what an optimal burn rate is for a startup depending on ARR. Burn rate mapped to growth rate can help founders and growth stage companies understand the optimal time to hire or start layoffs.

Operating Partner @ OpenView | Growth Unhinged 🚀

What's a "normal" burn rate for a startup? ⤵ Here are benchmarks from 700+ SaaS companies. A few observations: 1. There is no optimal burn rate. - What's healthy for one business might lead another startup to run out of cash. - Consider the level of cash on hand & confidence that any investments will leave the business better off. 2. What's "normal" today looks wildly different from 2021/2022. - Median burn rates are down materially year-over-year. - The biggest decreases are among SaaS companies with $5M+ ARR & especially those with $20M+ ARR. - The median monthly burn rate for a $20-$50M ARR biz fell from $1.5M (2022) to only ~$100-150k (2023). 3. "Normal" depends on your size and growth rate. - Higher growth SaaS companies with $20M+ ARR are still burning an average of ~$1M per month. Only ~5% of these companies are breakeven or profitable. - On the flip side, a lower growth SaaS company with $1-5M ARR is now only burning ~$50k per month. About ~25% of these companies are breakeven or profitable. 4. Be prepared for potential layoffs if burn starts to diverge from growth. According to layoffs.fyi, tech layoffs increased again in January to ~31,000 people. The silver lining is that this is down by almost 70% from the peak in January 2023 (~90,000 people). Let me know what you think: is this level of burn "healthy" or are we going to see even more cuts in 2024? -- 🎁 PS - Tap "view my blog" below my name for more data & stories about growing a SaaS startup. #saas #finance #startupfunding

To view or add a comment, sign in

FinTech Builder

Don’t know what a burn rate is. Stay out of startups. It’s how fast a startup spends its cash reserves. And it’s probably the reason most businesses have difficulty growing. Because to put in the infrastructure to grow sales and operations costs money.

Operating Partner @ OpenView | Growth Unhinged 🚀

What's a "normal" burn rate for a startup? ⤵ Here are benchmarks from 700+ SaaS companies. A few observations: 1. There is no optimal burn rate. - What's healthy for one business might lead another startup to run out of cash. - Consider the level of cash on hand & confidence that any investments will leave the business better off. 2. What's "normal" today looks wildly different from 2021/2022. - Median burn rates are down materially year-over-year. - The biggest decreases are among SaaS companies with $5M+ ARR & especially those with $20M+ ARR. - The median monthly burn rate for a $20-$50M ARR biz fell from $1.5M (2022) to only ~$100-150k (2023). 3. "Normal" depends on your size and growth rate. - Higher growth SaaS companies with $20M+ ARR are still burning an average of ~$1M per month. Only ~5% of these companies are breakeven or profitable. - On the flip side, a lower growth SaaS company with $1-5M ARR is now only burning ~$50k per month. About ~25% of these companies are breakeven or profitable. 4. Be prepared for potential layoffs if burn starts to diverge from growth. According to layoffs.fyi, tech layoffs increased again in January to ~31,000 people. The silver lining is that this is down by almost 70% from the peak in January 2023 (~90,000 people). Let me know what you think: is this level of burn "healthy" or are we going to see even more cuts in 2024? -- 🎁 PS - Tap "view my blog" below my name for more data & stories about growing a SaaS startup. #saas #finance #startupfunding

To view or add a comment, sign in

2,253 followers

New data around burn rates in SaaS. See you how compare 💰🔥 #saasbenchmarks #cashflow #funding

Operating Partner @ OpenView | Growth Unhinged 🚀

What's a "normal" burn rate for a startup? ⤵ Here are benchmarks from 700+ SaaS companies. A few observations: 1. There is no optimal burn rate. - What's healthy for one business might lead another startup to run out of cash. - Consider the level of cash on hand & confidence that any investments will leave the business better off. 2. What's "normal" today looks wildly different from 2021/2022. - Median burn rates are down materially year-over-year. - The biggest decreases are among SaaS companies with $5M+ ARR & especially those with $20M+ ARR. - The median monthly burn rate for a $20-$50M ARR biz fell from $1.5M (2022) to only ~$100-150k (2023). 3. "Normal" depends on your size and growth rate. - Higher growth SaaS companies with $20M+ ARR are still burning an average of ~$1M per month. Only ~5% of these companies are breakeven or profitable. - On the flip side, a lower growth SaaS company with $1-5M ARR is now only burning ~$50k per month. About ~25% of these companies are breakeven or profitable. 4. Be prepared for potential layoffs if burn starts to diverge from growth. According to layoffs.fyi, tech layoffs increased again in January to ~31,000 people. The silver lining is that this is down by almost 70% from the peak in January 2023 (~90,000 people). Let me know what you think: is this level of burn "healthy" or are we going to see even more cuts in 2024? -- 🎁 PS - Tap "view my blog" below my name for more data & stories about growing a SaaS startup. #saas #finance #startupfunding

To view or add a comment, sign in

I help companies streamline finances, tackle taxes, manage payroll and master compliances 🚀 ► Due diligences ► Cross border structuring ► Startup Advisory ► Funding compliances ► FEMA

Startups are laying off people. It's brutal, but true. Are you a founder? Feel like you're walking a tightrope? Take a breath. We've got this. Here's your survival guide to avoid layoffs and keep your team intact. 1. The Financial Plan. It's your guiding star. Know your revenues, forecast your expenses, project your cash flows. 12 months ahead? Good. 24 months ahead? Even better. 2. Budgeting is your Best Friend. Got funding? Great. Now, don't let it burn a hole in your pocket. Keep an eye on your expenses, adjust when needed. Remember, the budget is your financial compass. 3. Profitability is the Name of the Game. Growth is attractive, but profitability is irresistible. Continuously scrutinize your model, pricing, costs. Your ultimate aim? Maximize profits, secure the future. 4. Don't Put All Your Eggs in One Basket. Single revenue stream? That's a gamble. Explore new markets, engage new customers, launch new products. Diversification - that's your shield in market storms. 5. Resource Allocation - Do it Right. Efficiency is the secret sauce to avoid layoffs. Keep tabs on each team's productivity, each department's contribution. High-impact areas get priority, non-essential costs get the axe. The startup journey is a wild ride, especially managing finances after funding comes in. But remember, as a founder, you're the captain. Navigate wisely. Layoffs? You can prevent them. Your startup's future? You can secure it. Challenges will come, no doubt. But you, founder, you can be prepared. Feeling the heat? I'm here. Together, we can strategize, implement, and steer your startup to financial health. With the right tactics, not only can we keep layoffs at bay, but we can also take down your competition. Let's do this. #startups #layoffs #managingfinances

To view or add a comment, sign in

Founder • Advisor • Helping founders bring emerging AI tech to market. • Fractional GTM • Sales shouldn’t be a dirty word :)

Is your company a zombie company? 🧟⚰️ Last month, I posted data suggesting that layoffs are likely slowing down compared to 2023, and company shutdowns & bad acquisitions will be on the rise. I recently learned more data that backs that up... Winning by Design received data from a bunch of startup and scaleup founders. Many companies are losing ARR. CAC is rising faster than expected. Cost of marketing and sales as a % of ARR is rising. Free cash flow is falling. Retention is falling. Yikes 😬 Higher interest rates make it harder to raise funding, even with strong financials. Companies at the median don't look like they stand a chance at raising. So what happens next? Profitability maybe? SaaS Capital estimates only 32% of VC-backed SaaS co's were breakeven or profitable as of August 2023. That's after layoffs peaked and fell. So unless they plan on laying off 𝘦𝘷𝘦𝘯 𝘮𝘰𝘳𝘦 of their critical staff, profitability isn't saving them. And this is a LOT of companies. Flipping through G2, you see how crowded SaaS is: 395 Marketing automation solutions 247 Sales intelligence companies 565 Email marketing solutions 151 Auto dialers 495 Chatbots 666 CRMs The market is oversaturated, financials are looking dismal, and VCs are more selective than ever. So yeah, get ready for a sh*t storm of shutdowns. And a lot of founders announcing "acquisitions" while conveniently leaving out the $$ 🤡 I don't want to hear ANY acquisition announcements without a dollar value attached and verified 😤 The zombies walk among us. How can you weather the storm: If you're a founder: • don't mishire • consider bootstrapping • focus on unit economics • focus on fewer, stronger GTM motions • hire experienced fractionals (like me) If you're an employee: • be conscious of your employer's financial state • build a deep understanding of business (acumen) • start offering services on the side • always be interviewing • build your network 👋 • hire a coach (also like me lol) The good news is, the non-zombie companies are likely to do spectacularly well from here on out. And there are a lot of them. Find them. Work with them. And stay positive 😎💪 #saassales #salestech #sales #startups

No alternative text description for this image

To view or add a comment, sign in

Founder & CEO at KoiReader Technologies | Delivering Value to Logistics, Supply Chain, and Industrial Automation Customers using KoiVision Platform and an AI Operating Model

#bootstrapped startups right now. But they’ve always been this way. 👉With current inflation at 17-30% level and with market and valuations taking a nosedive, we can expect to see 17-30% layoffs in #venturebacked, #lossmaking companies. 👉This has already begun as we’ve seen reports from some big names. But what’s not visible to everyone is the Department of Labor’s WARN data (Worker Adjustment and Retraining Notification Act) that helps ensure advance notice in cases of qualified plant closings and mass layoffs. A wave of layoffs in such loss-making companies is coming in 2024. https://lnkd.in/dEnVbtmc The cool surfers in the video below who are not waiting for a wave (valuation jump) obviously represent the bootstrapped startups that focused on building a profitable business from the start. #valueovervaluations Credits: Flying_Pixels Welcome to the Jungle.

To view or add a comment, sign in

Founder & CEO of HomeMonde

Let's Navigate Startup Realities today. . . Last week, I had a conversation with friends who opened up a riveting conversation about the intense pressure startups face from VC firms and investors. Their main goal is to boost profits and attain the coveted exit, driving companies toward listing on secondary markets. The initial advice for profitability often leans towards cost-cutting, initiating a series of mass layoffs. However, this notion sparks a significant debate for a crucial reason. 👉 Rethinking Scale and Sustainability: Why embark on excessive hiring if the endgame is aggressive layoffs? It's a reminder that professionals aren't mere placeholders but the architects of growth, tasked with scaling, revenue maximization, and enhancing product quality. 👉 The True Purpose of Hiring: Each role added has a purpose – lightening workloads, amplifying revenue streams, and refining product and service excellence. 👉 Quality vs. Cutbacks A critical concern emerges. If numerous layoffs occur, can a company sustain the quality that defines its offerings? Whether product-centric or service-driven, delivering excellence becomes a formidable challenge. 👉 A Journey of Strategic Growth: In startups, scaling rapidly is imperative. Yet, it must be done responsibly and sustainably. Opt for a frugal strategy that acts as a safety net during testing periods, ensuring all stakeholders are secure. 👉 Balance Beyond Branding: Startup success isn't solely about extravagant branding. It's about channeling resources wisely, cultivating a brand that thrives on genuine value, and avoiding pitfalls. 👉 Crafting a Secure Future: Balancing growth with sustainability shapes a robust future. Strive to minimize the burn rate associated with aggressive promotions. Let's ensure the path ahead is prosperous and pleasant for everyone involved. #startups #startup #entrepreneurship #entrepreneur

To view or add a comment, sign in

(MBA 23-25) Marketing- Symbiosis Institute of Management Studies|Aspiring Marketer, Trader & Entrepreneur

Not a good year for startups as of April with so many layoffs and global economic disturbance. Many startups have been forced to make tough decisions, including layoffs, to weather the storm. While this is undoubtedly a difficult situation, there are both negative and positive impacts of these layoffs on startups. 🤐 On the negative side, layoffs can have a significant impact on a startup's culture and productivity. Losing key team members can result in a loss of institutional knowledge, experience, and expertise. Moreover, layoffs can demoralize the remaining team members, leading to decreased motivation and productivity. 🙁 Additionally, layoffs can be costly, both financially and in terms of time and resources. Severance packages and unemployment benefits can add up quickly, and the process of finding and hiring new talent can be lengthy and expensive. 👀 On the positive side, however, layoffs can also be an opportunity for startups to streamline and focus their operations. When resources are limited, startups are forced to prioritize and make tough decisions about where to allocate their time and money. By eliminating unnecessary positions and projects, startups can become more efficient and agile. 🧠 Furthermore, layoffs can create a sense of urgency and a renewed focus on growth and profitability. When faced with the possibility of failure, startups often double down on their core mission and work harder to achieve their goals. In conclusion, while startup layoffs are undoubtedly a difficult situation, they can also present opportunities for growth and improvement. By remaining focused on their mission and being strategic about their operations, startups can weather the storm and emerge stronger on the other side. #startup #layoffs #COVID19 #pandemic #businessimpact #efficiency #streamlining #focus #growth #profitability #teammanagement #motivation #productivity #leadership #resilience #opportunities #strategicplanning #restructuring #reorganization #workforceplanning

To view or add a comment, sign in

Founder, Picxele (Bootstrapped to 10Cr+ Revenue), Managed Gig Workers Platform | Angel Investor in 60 Startups

Recently helped a startup reduce their burn from 83L to 65L There are so many news we hear on daily basis startups cutting down the costs In the form of layoffs, marketing budget and other things Knew a company for a long while (Definitely can't share the name) Who was having an average Burn of 83L in Jan-Mar month Had a discussion with founders on various fronts where he was checking How I managed to sustain my first 3 years of Picxele with not even single tools being used Moreover with team size of 4-5 throughout There are so many costs which keep on increasing as the company grows And due to multiple reasons the founder cannot keep an eye Ending up missing and spending money in places where few things aren't needed And that's where in the last 3 months worked on from top to bottom along with him to bring the burn of 65L without even removing a single team member Here are a few things which i did there ✅ Removed couple of Tools/Software which were not needed or replaced with some with better pricings ✅ Stopped the hiring for the entire company and open up the reshuffle option for the employees with some taking up more ownership ✅ Removing agencies which were charging a lot for a similar kind of work which got replaced by Part Time Gig Workers at Picxele™ on task based mechanism ✅ Optimised the marketing budgets by removing the channels which were having higher CAC and focusing on the ones which were giving results and ultimately growth was never compromised ✅ Looking up on entire FY23 expenses and identifying the places where spent was happening which was of no use and company can eventually run without them This helped the founder Increased the runway of more 4 months with total money he had in his bank The very first thing I told him was that we will not remove any team members until anyone wants to go by themselve It was that one thing which I also got excited about because when the company keeps growing And you have VC money, you forget to cut down costs in places where it's not needed Hence, we both realised Layoff is not the only solution to cut down the costs

To view or add a comment, sign in